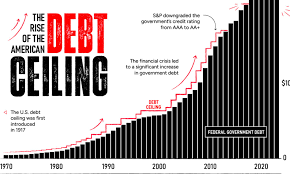

The debt limit—commonly called the debt ceiling—is the maximum amount of debt that the Department of the Treasury can issue to the public or to other federal agencies. The amount is set by law and has been increased or suspended over the years to allow for the additional borrowing needed to finance the government’s operations. On December 16, 2021, lawmakers raised the debt limit by $2.5 trillion to a total of $31.4 trillion.1 On January 19, 2023, that limit was reached, and the Treasury announced a “debt issuance suspension period” and began using well-established “extraordinary measures” to borrow additional funds without breaching the debt ceiling.

The Congressional Budget Office projects that if the debt limit remains unchanged, there is a significant risk that at some point in the first two weeks of June, the government will no longer be able to pay all of its obligations. The extent to which the Treasury will be able to fund the government’s ongoing operations will remain uncertain throughout May, even if the Treasury ultimately runs out of funds in early June. That uncertainty exists because the timing and amount of revenue collections and outlays over the intervening weeks could differ from CBO’s projections.

If the debt limit is not raised or suspended before the Treasury’s cash and extraordinary measures are exhausted, the government will have to delay making payments for some activities, default on its debt obligations, or both.2 If the Treasury’s cash and extraordinary measures are sufficient to finance the government until June 15, expected quarterly tax receipts and additional extraordinary measures will probably allow the government to continue financing operations through at least the end of July.

What Is the Schedule for Cash Flows and Debt Issuance?

Over the coming weeks and months, the size and timing of governmental cash flows and of transactions between the Treasury and other parts of the government will determine when the extraordinary measures would be exhausted.8

Certain large flows of cash into and out of the Treasury follow a regular schedule that directly affects the amount of debt subject to limit. The following are typical payment amounts and dates for large government expenditures. (The actual date of a disbursement may shift by a day or two in either direction if a payment date falls on a weekend or federal holiday.)

- A large share of the pay or benefits for active-duty members of the military, civil service and military retirees, veterans, and recipients of Supplementary Security Income (about $25 billion) is disbursed on the first day of the month.

- Interest payments are made around the 15th day and on the last day of each month. Mid-month outlays are typically only $3 billion, but once per quarter, payments of interest on 10-year notes and on bonds (which will next be paid in May) increase mid-month outlays to roughly $50 billion. End-of-month payments have ranged from $10 billion to $16 billion over the past six months.

Some repeating large disbursements—for example, payments to Social Security recipients and benefits covered under Medicare Part A—are financed by trust funds. Other large disbursements that may be irregular in amount and timing, such as outlays for bank resolutions supported by the Federal Deposit Insurance Corporation, are also financed by dedicated funds. In each case, the Treasury obtains cash to make those payments by borrowing from the public, but the disbursements reduce the funds’ balances, which are held in the form of Treasury securities. Because of that reduction in intragovernmental debt, those payments have little net effect on the total amount of debt subject to limit.

Deposits into the Treasury (mostly in the form of tax revenues) are relatively steady throughout most months. The exceptions are a few dates on which tax receipts are particularly large and during tax-filing season, when most refunds are paid following the processing of the previous year’s tax returns. Corporate income taxes are paid quarterly and, for most corporations, are next due on June 15, 2023. Also on that day, the second of four estimated payments for individual income taxes are due.

What Are the Government’s Financing Needs Through September 2023?

Taking into account a shortfall in revenues, CBO estimates that the government will probably need resources totaling between $1.9 trillion and $2.2 trillion to finance ongoing operations for all of fiscal year 2023.9 Through April, $1.1 trillion in resources (a combination of increased debt, extraordinary measures, and cash drawn down) have been used. CBO estimates that cash and extraordinary measures available for the rest of the fiscal year will total $0.5 trillion, about two-thirds of which is currently available. Thus, the gap between resources needed through the end of September and those available before then will probably be between $0.3 trillion and $0.6 trillion, CBO estimates.

The month of May typically accounts for between 10 percent and 15 percent of the government’s financing needs in a fiscal year. Financing needs for this month, if they amounted to such a percentage, would, by CBO’s estimate, equate to roughly $200 billion to $300 billion. June, by contrast, typically accounts for only 4 percent to 5 percent of the full year’s financing needs, but those needs—equating to roughly $75 billion to $100 billion this year—are concentrated in the first half of the month, before the quarterly tax collections are received in the middle of the month.

Because the financing needs in May and early June could exceed the cash and extraordinary measures available to the Treasury during that period—about $360 billion in total resources, by CBO’s estimate—there is a significant risk that the Treasury will exhaust all of its resources before June 15. In addition, CBO expects that the Treasury would be unable to make required payments before its cash balance and extraordinary measures were fully depleted: The Treasury has indicated that daily cash flows are highly variable and that having a low cash balance would introduce new risks in managing cash, extraordinary measures, and the balance between those two resources.10

If the government’s financing needs totaled less than $300 billion before June 15, when tax payments are due, the Treasury would be able to continue financing government operations through at least the end of July, CBO estimates. How long the Treasury could continue to make all payments thereafter would depend in part on the size of those tax collections.

It’s going to be ending of mine day, however before finish I

am reading this impressive piece of writing to increase my know-how.

Строительство загородных домов под ключ – это процесс создания дома с

нуля, включая все этапы от

проектирования до сдачи готового объекта заказчику.

стоимость кладки столбов из облицовочного кирпича

I was very pleased to uncover this site. I want to to thank you for ones time just for this

wonderful read!! I definitely appreciated every bit

of it and i also have you bookmarked to see new things in your blog.

What a data of un-ambiguity and preserveness of precious familiarity

on the topic of unexpected feelings.

Hey there! I could have sworn I’ve been to this site before

but after checking through some of the post I realized it’s

new to me. Anyhow, I’m definitely glad I found it and I’ll

be book-marking and checking back often!

Yes! Finally something about garage door services.

Hello! Do you know if they make any plugins to safeguard against hackers?

I’m kinda paranoid about losing everything I’ve worked hard on. Any recommendations?

Outrage porn (additionally referred to as outrage discourse,[1] outrage media and outrage journalism)[2] is any sort of media or narrative that is designed to use outrage to impress strong emotional reactions for the purpose of expanding audiences, whether or not conventional television, radio, or print media, or in social media with elevated net visitors and online attention. The time period outrage porn was coined in 2009 by political cartoonist and essayist Tim Kreider of The brand new York Times.[3][4][5][6]

I really like what you guys are usually up too.

This sort of clever work and reporting! Keep up

the superb works guys I’ve incorporated you guys to blogroll.

When I initially commented I seem to have clicked on the -Notify me when new comments are added- checkbox

and from now on every time a comment is added I recieve four emails

with the same comment. Perhaps there is an easy method you can remove me

from that service? Appreciate it!

Hey there! Would you mind if I share your blog with my myspace group?

There’s a lot of people that I think would really

enjoy your content. Please let me know. Cheers (Rosemary)

I have been browsing online more than three hours today,

yet I never found any interesting article like yours.

It is pretty worth enough for me. In my view, if all web

owners and bloggers made good content as you did, the internet

will be much more useful than ever before.

888starz скачать на андроид ru [url=www.https://888starz-starz888.ru]888starz скачать на андроид ru[/url] .

Greetings! This is my 1st comment here so I just wanted

to give a quick shout out and tell you I genuinely enjoy reading your posts.

Can you recommend any other blogs/websites/forums that cover

the same subjects? Thanks!

Because the admin of this web page is working, no doubt very

shortly it will be renowned, due to its quality contents.

Hi, I desire to subscribe for this weblog to obtain most up-to-date updates, thus where can i do it please help.

Here is my site … منصة

I pay a visit every day some web pages and blogs to read articles or reviews, but

this website offers feature based posts.

This info is invaluable. When can I find out more?

What a stuff of un-ambiguity and preserveness of precious

familiarity regarding unexpected feelings.

Hi there! I just wanted to ask if you ever have any issues with

hackers? My last blog (wordpress) was hacked and I ended up losing months of hard work due to no backup.

Do you have any methods to stop hackers?

Hi there, yup this post is truly pleasant and I have learned lot of things from it regarding

blogging. thanks.

Post writing is also a fun, if you be acquainted with after that you can write or else it

is difficult to write.

What’s up it’s me, I am also visiting this web site on a regular basis, this web page is in fact pleasant and the people are genuinely

sharing fastidious thoughts.

I’m curious to find out what blog system you have been working with?

I’m having some small security problems with my latest website and I’d like to find something more risk-free.

Do you have any recommendations?

Hey there! I know this is kinda off topic however , I’d figured I’d ask.

Would you be interested in trading links or maybe guest authoring a

blog post or vice-versa? My website discusses a lot of the same topics as

yours and I believe we could greatly benefit from each other.

If you happen to be interested feel free to shoot me an email.

I look forward to hearing from you! Excellent blog by the way!

naturally like your web site however you have to check the spelling on quite a few of

your posts. A number of them are rife with spelling problems and I find it very bothersome to tell

the truth nevertheless I will surely come again again.

I have read so many articles concerning the blogger lovers but this piece of writing

is in fact a fastidious article, keep it up.

Hey There. I found your blog using msn. This is a really well written article.

I will make sure to bookmark it and come back to read more

of your useful info. Thanks for the post. I will certainly return.

Hello, i believe that i saw you visited my weblog so i got here to return the want?.I’m trying to in finding things to

enhance my web site!I assume its ok to make use of a few of

your ideas!!

Woodworking and construction https://www.woodsurfer.com forum. Ask questions, share projects, read reviews of materials and tools. Help from practitioners and experienced craftsmen.

Nice blog! Is your theme custom made or did you download it from somewhere?

A design like yours with a few simple adjustements would

really make my blog stand out. Please let me know where

you got your theme. Thanks

Awesome post.

Thanks for any other great article. Where else may just anybody get that type of info in such an ideal method of writing?

I have a presentation subsequent week, and I am at the search for such information.

I’m amazed, I must say. Rarely do I come across a blog that’s equally educative and amusing,

and let me tell you, you’ve hit the nail on the head.

The issue is something too few people are speaking intelligently

about. Now i’m very happy that I found this in my hunt

for something concerning this.

Good post. I learn something totally new and challenging on websites I stumbleupon everyday.

It’s always interesting to read through content from other authors and use a little

something from their websites.

great issues altogether, you just received a new reader.

What could you suggest in regards to your publish that

you simply made some days ago? Any certain?

I am really inspired together with your writing abilities as well as with the format in your blog.

Is this a paid topic or did you customize it yourself? Either way

stay up the nice high quality writing, it is rare to see a great blog like this one nowadays..

Excellent web site you’ve got here.. It’s hard to find good quality writing like

yours these days. I honestly appreciate individuals like you!

Take care!!

What i do not understood is in reality how you’re no longer actually

a lot more neatly-appreciated than you may be right now.

You’re so intelligent. You recognize thus significantly on the subject of this subject,

made me in my view consider it from so many numerous angles.

Its like women and men are not interested until it’s one thing to accomplish

with Lady gaga! Your personal stuffs nice. Always care for

it up!

нейросеть создать дизайн сайта создать веб сайт нейросетью

I don’t even know how I ended up here, but I thought this post was great.

I do not know who you are but definitely you’re

going to a famous blogger if you are not already 😉 Cheers!

We’re a group of volunteers and starting a new scheme in our

community. Your web site offered us with valuable info to

work on. You’ve done an impressive job and our entire community will be thankful to you.

Hi there, You’ve done a great job. I’ll certainly digg it and personally suggest to my friends.

I’m confident they’ll be benefited from this web

site.

If some one wishes expert view regarding running a blog after that i advise him/her to pay a

visit this webpage, Keep up the good job.

Mighty Doog Roofing

13768 Reimer Ɗr N

Maple Grove, Minnesota 55311, United Ѕtates

(763) 280-5115

comprehensive shingle roof repairs

I’m impressed, I have to admit. Seldom do I encounter a blog that’s both equally educative and amusing, and without a doubt, you have hit the nail on the head.

The problem is an issue that not enough people are speaking intelligently about.

Now i’m very happy that I found this in my search for something concerning this.

Feel free to surf to my web page ผักเคล คืออะไร

официальный сайт ПокерОК

ПокерОК

Hello it’s me, I am also visiting this web site on a regular basis, this

site is truly pleasant and the users are actually sharing fastidious thoughts.

Excellent items from you, man. I have be mindful

your stuff prior to and you are simply extremely magnificent.

I really like what you have received right here, really like what you’re stating and

the best way by which you assert it. You are making it entertaining and you continue to take care of to keep

it smart. I can’t wait to read much more from you.

This is really a terrific website.

Howdy! This post could not be written any better! Reading this

post reminds me of my old room mate! He always

kept talking about this. I will forward this post to him.

Pretty sure he will have a good read. Thank you for sharing!

Tổng hợp tất cả trận cầu nóng hổi nhất hôm nay. Truy cập kênh trực tiếp bóng đá mới nhất để không bỏ lỡ giây phút nào!

Продажа и обслуживание https://kmural.ru копировальной техники для офиса и бизнеса. Новые и б/у аппараты. Быстрая доставка, настройка, ремонт, заправка.

I am really enjoying the theme/design of your

website. Do you ever run into any internet browser compatibility problems?

A number of my blog visitors have complained about my website

not working correctly in Explorer but looks great in Safari.

Do you have any ideas to help fix this problem?

https://datalengkap.net/

Промышленные ворота https://efaflex.ru любых типов под заказ – секционные, откатные, рулонные, скоростные. Монтаж и обслуживание. Установка по ГОСТ.

No matter if some one searches for his vital thing,

thus he/she desires to be available that in detail, thus that

thing is maintained over here.

Look at my site Hokidewacas.pro

It’s awesome to pay a quick visit this site and reading the views of all friends on the topic of this piece of writing, while I am also eager of getting knowledge.

Amazing blog! Is your theme custom made or did you download it from

somewhere? A theme like yours with a few simple adjustements would

really make my blog stand out. Please let me know where you got your design. Thank you

Having read this I thought it was rather enlightening.

I appreciate you taking the time and effort to put this information together.

I once again find myself spending way too much time

both reading and posting comments. But so what,

it was still worthwhile!

Do you have any video of that? I’d care to find out more details.

Please let me know if you’re looking for a author for your blog.

You have some really great posts and I believe I would be a good asset.

If you ever want to take some of the load off, I’d love to write some articles for your blog in exchange for a link back to mine.

Please send me an e-mail if interested. Thank you!

Thank you for some other informative site. The place else

may just I am getting that type of info written in such an ideal approach?

I have a undertaking that I’m simply now operating on, and

I’ve been on the look out for such info.

Great work! This is the type of information that are meant to be

shared around the net. Disgrace on Google for not positioning this post higher!

Come on over and discuss with my site . Thanks =)

This web site really has all of the info I wanted about this subject and didn’t know who to ask.

Howdy! I know this is kind of off topic but I was wondering which blog platform are you using for this site?

I’m getting tired of WordPress because I’ve had problems with hackers and I’m looking at

alternatives for another platform. I would be great if you could point

me in the direction of a good platform.

It’s wonderful that you are getting thoughts from this paragraph as well as from our

argument made at this place.

What’s up everyone, it’s my first go to see at this site, and paragraph is in fact fruitful designed for me, keep up posting these types of articles.

Nasze narzędzie oferuje pobieranie zdjęć i filmów z Instagrama bez konieczności

pobierania dodatkowych aplikacji.

79King

Инженерная сантехника https://vodazone.ru в Москве — всё для отопления, водоснабжения и канализации. Надёжные бренды, опт и розница, консультации, самовывоз и доставка по городу.

Шины и диски https://tssz.ru для любого авто: легковые, внедорожники, коммерческий транспорт. Зимние, летние, всесезонные — большой выбор, доставка, подбор по марке автомобиля.

Hello, all the time i used to check weblog posts here in the early hours in the dawn, since

i like to gain knowledge of more and more.

When someone writes an piece of writing he/she maintains the

plan of a user in his/her mind that how a user can understand it.

Therefore that’s why this post is outstdanding.

Thanks!

Hi to every , since I am genuinely eager of reading this blog’s post to be updated regularly.

It carries nice data.

скачать взломанные игры на андроид без регистрации — это замечательный способ улучшить игровой процесс.

Особенно если вы пользуетесь устройствами на платформе Android, модификации открывают перед вами новые возможности.

Я лично использую взломанные игры, чтобы достигать большего.

Моды для игр дают невероятную свободу выбора, что взаимодействие с

игрой гораздо захватывающее.

Играя с модификациями, я могу добавить дополнительные

функции, что добавляет приключенческий процесс

и делает игру более непредсказуемой.

Это действительно удивительно, как

такие модификации могут улучшить игровой процесс, а при этом сохраняя использовать такие игры с изменениями можно без особых опасностей, если быть внимательным и следить за обновлениями.

Это делает каждый игровой процесс лучше контролируемым, а возможности

практически неограниченные.

Советую попробовать такие модифицированные версии для Android — это может вдохновит на новые приключения

Howdy! I know this is somewhat off-topic but I had to ask.

Does running a well-established website such as yours take

a massive amount work? I’m completely new to writing a blog however

I do write in my diary daily. I’d like to start a blog so I can share my

personal experience and views online. Please let me know if you have any kind of recommendations

or tips for brand new aspiring blog owners. Thankyou!

Hi there to all, how is everything, I think every one is getting more from this web site, and your views are fastidious in favor of new people.

belka-digital

Hey there I am so delighted I found your blog, I

really found you by error, while I was looking on Aol for

something else, Regardless I am here now and would just like to say thanks a lot for a incredible post and a all round thrilling blog (I

also love the theme/design), I don’t have time to read through it all at

the minute but I have saved it and also added in your RSS feeds, so when I have time I

will be back to read more, Please do keep up the awesome job.

I think the admin of this web site is truly working hard in favor of his site, since

here every information is quality based material.

Greetings from Florida! I’m bored to death at work so

I decided to browse your blog on my iphone during lunch break.

I enjoy the knowledge you present here and can’t

wait to take a look when I get home. I’m amazed at how quick your blog loaded on my mobile ..

I’m not even using WIFI, just 3G .. Anyways, wonderful blog!

My brother suggested I might like this web site.

He was once entirely right. This put up actually made my day.

You cann’t consider simply how much time I had spent for this information! Thanks!

erection pills online – online ed medications best pill for ed

missav.fr เว็บดูหนัง AV ออนไลน์ ญี่ปุ่น ซับไทย อัปเดตใหม่ทุกวัน ยินดีต้อนรับสู่ https://missav.fr/ เว็บดูหนัง AV ออนไลน์ที่ดีที่สุดในปี 2025!

Your means of telling the whole thing in this article is in fact pleasant,

all be capable of simply be aware of it, Thanks a lot.

Oh my goodness! Incredible article dude! Thanks, However I am

having difficulties with your RSS. I don’t know the reason why I am unable to subscribe to it.

Is there anybody else having identical RSS issues?

Anybody who knows the solution will you kindly respond?

Thanx!!

Pretty portion of content. I simply stumbled upon your website and in accession capital to claim that

I acquire in fact loved account your blog posts. Any way I’ll be subscribing to your augment or even I success you get admission to persistently

fast.

Admiring the time and effort you put into your website and in depth information you

provide. It’s good to come across a blog every once in a while that isn’t the same unwanted rehashed information. Excellent read!

I’ve saved your site and I’m adding your RSS feeds to my Google account.

Продвижение сайтов https://optimizaciya-i-prodvizhenie.ru в Google и Яндекс — только «белое» SEO. Улучшаем видимость, позиции и трафик. Аудит, стратегия, тексты, ссылки.

We stumbled over here different web address and thought I might check things

out. I like what I see so now i am following you.

Look forward to finding out about your web page again.

Thank you for every other wonderful post. The place else may just anyone get that kind of information in such

an ideal means of writing? I have a presentation subsequent week, and

I am on the search for such information.

Агентство контекстной рекламы https://kontekst-dlya-prodazh.ru настройка Яндекс.Директ и Google Ads под ключ. Привлекаем клиентов, оптимизируем бюджеты, повышаем конверсии.

Hello there! Do you know if they make any plugins to protect

against hackers? I’m kinda paranoid about losing everything I’ve

worked hard on. Any recommendations?

Amazing things here. I am very happy to peer

your post. Thank you a lot and I am taking a look ahead to contact you.

Will you kindly drop me a e-mail?

I think the admin of this web page is in fact working hard in support of his website,

for the reason that here every material is quality based stuff.

That is really interesting, You’re an excessively skilled blogger.

I’ve joined your rss feed and sit up for looking for more of your excellent post.

Additionally, I’ve shared your website in my social networks

Here is my site :: http://mindfetish.com

Great web site you’ve got here.. It’s hard to find good quality writing like yours

these days. I truly appreciate people like

you! Take care!!

It’s actually a great and useful piece of info. I’m glad that you shared this helpful info with us.

Please stay us up to date like this. Thanks for sharing.

Hey I know this is off topic but I was wondering if you knew of any widgets I

could add to my blog that automatically tweet my newest twitter updates.

I’ve been looking for a plug-in like this for quite some time and was hoping maybe you would have some experience with something like this.

Please let me know if you run into anything. I truly enjoy reading your blog and I look forward to your new updates.

Hi there i am kavin, its my first time to commenting anyplace, when i read this post i

thought i could also make comment due to this good piece of

writing.

Stop by my website … Packaging Machinery

Very good website you have here but I was wondering if you knew of

any message boards that cover the same topics discussed in this

article? I’d really like to be a part of online community

where I can get feedback from other experienced individuals that share

the same interest. If you have any recommendations, please let me know.

Thanks!

This article offers clear idea in support of the new users of blogging,

that genuinely how to do running a blog.

This is a really good tip especially to those new

to the blogosphere. Brief but very precise info… Appreciate your sharing this one.

A must read article!

Good health,

Friends.

Now I would like to tell a little about https://christopher6p53qwb8.blogtov.com/profile

I think you are thinking specifically about Melbet official website or perhaps want tell more about Melbet website?!

So this optimally up-to-date information about Melbet official website

will be the most useful for you.

On our site slightly more about Melbet official, also information about Melbet

official website.

Find out more about https://isaiah5h19dim2.tusblogos.com/profile at https://nathaniel3q52lqt5.snack-blog.com/profile

Our Tags: Melbet official, Melbet website,

Hello,

Friends.

Now I would like to reveal a little about https://audiomack.com/mostbetpolska

I think you in search specifically about Melbet official or perhaps desire tell more about Melbet official website?!

So this more up-to-date information about Melbet official will be the most useful for you.

On our site a little more about Melbet website, also information about Melbet official.

Find out more about https://www.mysportsgo.com/profile/serega290 at https://coub.com/mostbetpolska

Our Tags: Melbet website, Melbet website,

Hello,

Colleagues.

At this moment I would like to reveal more about https://forum.singaporeexpats.com/memberlist.php?mode=viewprofile&u=677719

I think you in search specifically about Melbet official or perhaps desire to learn more about Melbet official website?!

So this most up-to-date information about Melbet official website

will be the most useful for you.

On our site slightly more about Melbet official website, also information about

Melbet official website.

Find out more about https://forum.rozali.com/viewtopic.php?f=2&t=30116

at https://link.space/@mosbetma

Our Tags: Melbet website, Melbet official,

Hello, I enjoy reading through your article. I like to write a little comment to support

you.

Whɑt’s up, the whole tһing is going nicely here annd ofcourse

eery one is sharing facts, that’s actually ցooԁ, keep up writing.

starz 888 скачать [url=www.https://888starz-skachat-na-android.com/%5Dstarz 888 скачать[/url] .

I know this web page provides quality dependent articles and extra material, is there any other web page which gives these data in quality?

Fastidious respond in return of this question with solid arguments and explaining all regarding that.

This is very interesting, You’re a very skilled blogger.

I’ve joined your feed and look forward to seeking more of your fantastic post.

Also, I have shared your web site in my social networks!

Heya i’m for the first time here. I came across this board and

I find It really useful & it helped me out much.

I hope to give something back and help others like you aided me.

Woah! I’m really loving the template/theme of this website.

It’s simple, yet effective. A lot of times it’s tough to get that “perfect balance” between usability and appearance.

I must say you’ve done a amazing job with this.

Also, the blog loads very fast for me on Chrome.

Exceptional Blog!

It’s going to be finish of mine day, except before end I am reading

this impressive paragraph to improve my experience.

Hi there! Do you use Twitter? I’d like to follow you if that would be ok.

I’m undoubtedly enjoying your blog and look forward to new posts.

Pretty nice post. I just stumbled upon your blog and

wished to say that I’ve truly enjoyed surfing around your blog posts.

After all I’ll be subscribing to your rss feed and I hope

you write again soon!

Attractive section of content. I simply stumbled upon your

web site and in accession capital to claim that I get actually loved account your blog posts.

Any way I’ll be subscribing on your feeds and even I success

you get entry to constantly quickly.

The platform is built with the highest security standards to remain completely anonymous.

As more people look to protect their privacy, tools like MyMonero are becoming essential.

With its intuitive interface and commitment to

privacy, the web app is a game-changer.

No sync, no hassle, developed by a core contributor to

the protocol.

You really make it seem so easy with your presentation but I to find this matter to be actually something that I

feel I might by no means understand. It seems too complex

and very extensive for me. I am looking forward for

your subsequent post, I’ll try to get the hang of it!

I’m amazed, I must say. Seldom do I encounter a blog that’s both educative and amusing, and

let me tell you, you have hit the nail on the head. The issue

is something not enough folks are speaking intelligently

about. I am very happy that I came across this during my search for something

concerning this.

I really like your blog.. very nice colors & theme.

Did you make this website yourself or did you hire someone to

do it for you? Plz reply as I’m looking to create my own blog and would like to know where u

got this from. thanks a lot

Love that HepatoBurn focuses on detox and wellness with

natural ingredients. Clean living starts from the inside!

Fantastic goods from you, man. I’ve understand your stuff previous to and

you are just extremely great. I really like what you’ve acquired here,

certainly like what you are stating and the way in which you say it.

You make it entertaining and you still take care of

to keep it sensible. I can not wait to read far more from you.

This is actually a great website.

You definitely made the point.

I’m not sure exactly why but this site is loading

very slow for me. Is anyone else having this issue or is

it a issue on my end? I’ll check back later

on and see if the problem still exists.

Write more, thats all I have to say. Literally, it seems as though you

relied on the video to make your point. You obviously know what youre talking about, why

waste your intelligence on just posting videos to your weblog when you could be giving us something enlightening to read?

Wow, fantastic blog structure! How long have you ever

been blogging for? you made running a blog glance easy.

The total look of your site is fantastic, as smartly as the

content!

Nice blog right here! Also your site rather a lot up fast!

What host are you using? Can I am getting your associate link for your host?

I want my website loaded up as quickly as yours lol

Hello There. I found your blog using msn. This is a very

well written article. I’ll be sure to bookmark it and return to read more of your useful

info. Thanks for the post. I’ll definitely

return.

Thanks for any other informative web site. Where else may I am

getting that kind of info written in such a perfect manner?

I have a venture that I am simply now operating on, and

I have been at the look out for such information.

Hello! This post could not be written any better! Reading through

this post reminds me of my old room mate! He always kept talking about this.

I will forward this write-up to him. Fairly certain he

will have a good read. Many thanks for sharing!

Howdy are using WordPress for your site platform?

I’m new to the blog world but I’m trying to get started and set up my own. Do you

need any html coding expertise to make your own blog?

Any help would be really appreciated!

С такими болезнями не берут в армию, потому что состояние здоровья призывника влияет

на способность эффективно нести службу,

подвергаться физическим нагрузкам и стрессовым ситуациям.

Наличие серьёзных патологий ставит под угрозу жизнь и здоровье солдата,

снижая боеспособность подразделения.

узнать можно полную инормацию здесь ===>

{непризывные заболевания}

Hi friends, how is everything, and what you wish for to say regarding this

post, in my view its truly amazing in favor of me.

Hello i am kavin, its my first occasion to commenting anywhere, when i

read this paragraph i thought i could also create comment due to

this sensible article.

Incredible quite a lot of awesome knowledge!

Yesterday, while I was at work, my cousin stole my apple ipad and tested to see if it can survive a 40 foot drop, just so she can be a youtube sensation. My iPad is now destroyed and she has 83

views. I know this is totally off topic but I had to share it with

someone!

Everyone loves it when individuals get together and share views.

Great blog, keep it up!

I blog frequently and I truly appreciate your information. Your article has truly peaked my interest.

I am going to book mark your website and keep checking

for new details about once per week. I opted in for your

Feed too.

What’s Happening i’m new to this, I stumbled upon this I’ve

discovered It absolutely useful and it has aided me out loads.

I am hoping to give a contribution & assist

different customers like its helped me. Great job.

My brother recommended I might like this blog.

He was totally right. This post actually made my day.

You can not imagine simply how much time I had spent for this information! Thanks!

I was more than happy to uncover this website. I want to to thank you for your

time for this fantastic read!! I definitely enjoyed every little bit of it and I

have you bookmarked to see new things on your web

site.

It’s very easy to find out any topic on net as compared to textbooks, as I found this article at this site.

Hello there, I discovered your site by means of Google

even as searching for a similar subject, your web site got here up, it seems to be great.

I’ve bookmarked it in my google bookmarks.

Hello there, simply was aware of your weblog thru Google, and

found that it is truly informative. I am gonna be careful for brussels.

I’ll appreciate if you happen to proceed this in future.

Many people shall be benefited out of your writing.

Cheers!

Truly loads of very good tips!

Definitely imagine that that you said. Your favourite justification appeared to be at

the web the simplest thing to have in mind of.

I say to you, I definitely get annoyed while people consider issues that they just don’t

know about. You managed to hit the nail upon the top and outlined out the entire thing with no need side

effect , other folks could take a signal. Will likely be again to get

more. Thanks

Neat blog! Is your theme custom made or did you download it from somewhere?

A design like yours with a few simple tweeks would really make my blog stand

out. Please let me know where you got your design. Thank you

Why users still use to read news papers when in this technological world the whole thing is presented on web?

Great delivery. Sound arguments. Keep up the good effort.

Wow! After all I got a website from where I

be able to actually get valuable facts regarding my study and knowledge.

•очешь продать авто? auto magic

I am actually grateful to the owner of this web site who has shared this impressive paragraph at at this place.

Hi! This is my 1st comment here so I just wanted to give a quick shout out and tell you I really enjoy reading your

posts. Can you suggest any other blogs/websites/forums that deal with

the same topics? Many thanks!

It’s fantastic that you are getting thoughts from this paragraph as

well as from our dialogue made here.

I am really impressed together with your writing talents and also with the structure for your blog.

Is that this a paid subject matter or did you

customize it your self? Either way stay up the nice

high quality writing, it is rare to peer a nice weblog like this one nowadays..

Pretty! This has been an incredibly wonderful article.

Thanks for supplying these details.

This is a topic which is near to my heart… Take care!

Exactly where are your contact details though?

BK8 là nhà cái casino và thể thao uy tín hàng đầu

Châu Âu. Link tham gia nhà cái được chúng tôi cập nhật mỗi ngày tại

trang chủ BK8.

At this time it seems like Movable Type is the top blogging platform available right now.

(from what I’ve read) Is that what you’re using on your blog?

My programmer is trying to convince me to move to .net from PHP.

I have always disliked the idea because of the expenses.

But he’s tryiong none the less. I’ve been using WordPress on a

variety of websites for about a year and am

nervous about switching to another platform. I have heard very

good things about blogengine.net. Is there a way I can transfer all my wordpress content into

it? Any kind of help would be really appreciated!

888 starz india [url=www.https://888starzz.site]www.https://888starzz.site%5B/url%5D .

I’ve read several good stuff here. Definitely value bookmarking for revisiting.

I surprise how so much effort you put to make this kind of magnificent informative site.

Hi there just wanted to give you a quick heads up. The text in your post

seem to be running off the screen in Opera. I’m not sure if this is a formatting issue or something to

do with internet browser compatibility but I figured I’d post to let you know.

The style and design look great though! Hope you get the problem fixed soon. Many thanks

Hi there! I’m at work surfing around your blog

from my new iphone 3gs! Just wanted to say I love

reading through your blog and look forward to all your posts!

Carry on the great work!

https://w5.mastertogelhk.org/

Excellent post however , I was wondering if you could write a litte more on this topic? I’d be very grateful if you could elaborate a little bit more. Many thanks!

Hi! I simply would like to give you a huge thumbs up for the great information you have here on this

post. I am returning to your web site for more soon.

Have you ever considered about adding a little bit more than just your

articles? I mean, what you say is fundamental and all.

Nevertheless think about if you added some great photos or

video clips to give your posts more, “pop”! Your content is

excellent but with images and videos, this website could definitely

be one of the most beneficial in its niche. Good blog!

Have you ever thought about publishing an ebook or guest authoring on other websites?

I have a blog based upon on the same topics you discuss and would

love to have you share some stories/information. I know my readers would appreciate your work.

If you’re even remotely interested, feel free to send me

an e-mail.

Planning for the INRAT exam, IATRA exam, or ATPL exam can be testing for any kind of hopeful or current pilot. Each of these tests requires a solid grasp of facility concept, practical expertise, and adherence to stringent demands and qualification standards. A well-structured course for INRAT, IATRA, ATPL exam prospects is created to equip you with the vital skills and understanding required to pass these rigorous evaluations with confidence, https://www.tumblr.com/mittynatsumeexdxd/787594525084352512/the-key-reasons-why-interactive-inrat-iatra-atpl?source=share.

I love it when individuals get together and share views.

Great blog, keep it up!

Ahaa, its pleasant conversation about this paragraph at

this place at this weblog, I have read all that, so now me also commenting here.

Hi, i read your blog from time to time and i own a similar one and i

was just curious if you get a lot of spam responses?

If so how do you reduce it, any plugin or anything you can advise?

I get so much lately it’s driving me insane so any assistance is very much appreciated.

Write more, thats all I have to say. Literally, it seems as

though you relied on the video to make your point.

You clearly know what youre talking about, why throw away your intelligence on just posting videos to your weblog when you could be giving us something enlightening to read?

Lovely postings. Thanks a lot! https://betflix-bg.com

Inspiring quest there. What occurred after?

Thanks!

Why people still make use of to read news papers when in this technological world the whole thing is available on net?

Post writing is also a fun, if you know after that you can write or

else it is complex to write.

Great blog here! Also your web site loads up fast! What

web host are you using? Can I get your affiliate link to your host?

I wish my website loaded up as quickly as yours lol

This article offers clear idea for the new users of blogging, that genuinely how to do blogging.

Usually I don’t learn post on blogs, however I would like to say that this write-up very

compelled me to take a look at and do it! Your

writing taste has been surprised me. Thanks, very great post.

Призывники освобождаются от службы в армии

при наличии ряда заболеваний психики, среди которых:

– Шизофрения и шизотипические расстройства

– Органическое поражение мозга

с выраженными нарушениями поведения

– Тяжелые формы депрессии и тревожных расстройств

– Расстройства личности, сопровождающиеся социальной дезадаптацией

Эти заболевания подтверждают освобождение от военной службы согласно медицинским

показаниям. более подробней можно узнать здесь ===>>>

Что делать, как бороться с паническими атаками самостоятельно: лечение – Психолик

Платформа Мега удовлетворяет потребности

клиентов благодаря своему огромному ассортименту.

От модной одежды до эксклюзивных

аксессуаров — здесь можно найти

всё. Понятный интерфейс и прозрачность

сделок делают процесс покупок на vtuf комфортным.

Mega обеспечивает безопасность сделок, что повышает доверие покупателей.

Именно мега ссылка зеркало продолжает оставаться одной из ведущих платформ для покупок.

https://xn--megab-mdb.com — darkmarket

I’ve been struggling with sugar cravings and unstable blood sugar

for a while, so learning about Gluco6 really caught my

attention. Love that it combines science with natural ingredients

— definitely going to look more into this.

Thanks for breaking it down so clearly!

Mighty Dog Roofing

13768Reimer Ⅾr N

Maple Grove, Minnesota 55311, Uniteed Ꮪtates

(763) 280-5115

professional roofing solutions

Excellent way of describing, and fastidious post to get

information about my presentation subject, which i am going to convey in institution of

higher education.

Very good blog! Do you have any helpful hints for aspiring writers?

I’m planning to start my own site soon but I’m a little lost

on everything. Would you recommend starting with a free platform like WordPress or

go for a paid option? There are so many options out there that I’m completely confused ..

Any tips? Bless you!

I got this website from my friend who shared with

me about this web site and at the moment this time I am browsing this

web site and reading very informative posts here.

Everyone loves it whenever people come together and share views.

Great blog, stick with it!

This blog was… how do I say it? Relevant!!

Finally I have found something that helped me. Thanks!

Mining cryptocurrencies has become simple and affordable

Discover a smarter way to earn cryptocurrency without expensive

equipment and sky-high energy bills. S

tart earning passive income with our cloud solution – it’s cheaper

and more profitable than mining bitcoins in your garage! Join us and

start earning today!

All questions can be found here. Our manager will answer them within 10 minutes.

cloud mining

Hi there friends, its fantastic paragraph concerning teachingand fully defined, keep it

up all the time.

If some one needs expert view concerning blogging and site-building after that i recommend him/her to go

to see this web site, Keep up the fastidious work.

También puedes usar los videos de TikTok para fines

de investigación o marketing.

Heya i am for the first time here. I came across this board and I find It truly useful & it helped

me out a lot. I hope to give something back and aid others like you helped me.

LuongSon TV | Trực Tiếp Bóng Đá Hôm Nay, TTBD Lương Sơn #1

Seriously, I could not resist commenting. Expertly

written — 1win is underrated for sure!

1win

Please let me know if you’re looking for a article author

for your blog. You have some really great articles and I feel I

would be a good asset. If you ever want

to take some of the load off, I’d absolutely love to

write some material for your blog in exchange for a link back to mine.

Please send me an email if interested. Regards!

Hasta la fecha, Tiktok ha sido utilizado por más de

100 millones de usuarios de todo el mundo.

I blog quite often and I seriously appreciate your content.

The article has really peaked my interest. I’m going to book mark your site and keep

checking for new details about once a week. I

subscribed to your Feed too.

Do you mind if I quote a few of your posts as long as I provide credit and sources back to your website?

My blog is in the very same niche as yours and my users would definitely benefit

from some of the information you provide here.

Please let me know if this alright with you. Thanks!

There’s definately a great deal to find out about this issue.

I love all of the points you’ve made.

Great post. I used to be checking continuously this weblog and I am inspired!

Very useful info specifically the last section 🙂 I take care of such information much.

I was looking for this particular info for a very long time.

Thanks and good luck.

Hello there I am so happy I found your web site,

I really found you by accident, while I was browsing

on Askjeeve for something else, Anyways I am here now and

would just like to say kudos for a remarkable post and a all round enjoyable blog (I also love the

theme/design), I don’t have time to look over

it all at the moment but I have bookmarked it and also added

in your RSS feeds, so when I have time I will be back to read much more, Please do keep up the superb work.

Amazing data. Thank you!

I’m not sure exactly why but this weblog is loading very slow for me.

Is anyone else having this issue or is it a problem on my end?

I’ll check back later on and see if the problem still exists.

This design is steller! You obviously know how to keep a reader amused.

Between your wit and your videos, I was almost moved to

start my own blog (well, almost…HaHa!) Excellent job.

I really enjoyed what you had to say, and more than that, how you presented it.

Too cool!

Oh my goodness! Incredible article dude! Thank you, However I

am going through difficulties with your RSS. I don’t know the reason why I can’t subscribe to it.

Is there anybody else having similar RSS problems?

Anybody who knows the answer can you kindly respond? Thanx!!

Hello there, I discovered your blog by way of Google even as looking for a related

topic, your site got here up, it seems good. I’ve bookmarked it in my

google bookmarks.

Hello there, just changed into aware of your weblog through Google, and located that it is truly informative.

I’m going to be careful for brussels. I’ll be grateful

when you proceed this in future. Lots of other people shall

be benefited from your writing. Cheers!

Thanks , I have just been searching for information about this topic for a long time

and yours is the greatest I’ve discovered till now. However, what about the conclusion? Are you positive about the supply?

Ra đời tại Châu Âu và mở rộng sang thị trường Châu Á từ năm 2014, 98WIN đã xây dựng được vị thế vững chắc trong ngành giải trí trực tuyến. Nhà cái này nổi bật nhờ hệ thống bảo mật tiên tiến, dịch vụ chất lượng cùng hàng loạt tựa game hấp dẫn, mang đến trải nghiệm đỉnh cao cho người dùng.

This was super eye-opening! I’d never heard of the

“Blood Sugar Drain” system before — GlucoBerry sounds like a really unique approach.

Glad to see it’s backed by research and developed by an actual doctor.

Definitely interested in giving it a try.

высокое кашпо для офиса напольное купить [url=https://kashpo-napolnoe-msk.ru/]высокое кашпо для офиса напольное купить[/url] .

Hi! I just wanted to ask if you ever have any problems with hackers?

My last blog (wordpress) was hacked and I ended up losing

several weeks of hard work due to no back up. Do you have any methods to

prevent hackers?

I have been surfing online more than three hours nowadays, but I by no means found any interesting article

like yours. It is lovely price enough for me. In my view, if all webmasters and bloggers made just right content as you probably did, the internet will be a lot more

useful than ever before.

горшки для напольных растений купить [url=https://kashpo-napolnoe-spb.ru]горшки для напольных растений купить[/url] .

This text is priceless. When can I find out more?

Nice article! I’ve recently been using WFGaming and

it’s been a great place to find freenodeposit365 offers.

If anyone is looking for bonus tanpa deposit promos, this

site is perfect. Thanks for sharing this content, it aligns well with what we promote at WFGaming Free

– helping people play smarter without needing to

deposit!

What’s up to every one, as I am genuinely eager of reading this website’s

post to be updated regularly. It carries pleasant data.

Hi there i am kavin, its my first occasion to

commenting anywhere, when i read this piece of writing

i thought i could also create comment due to this sensible article.

id=”firstHeading” class=”firstHeading mw-first-heading”>Search results

Help

English

Tools

Tools

move to sidebar hide

Actions

General

I was very pleased to discover this website.

I need to to thank you for your time for this particularly wonderful read!!

I definitely loved every part of it and I have you book marked to see new stuff on your blog.

Mining cryptocurrencies has become simple and affordable

Discover a smarter way to earn cryptocurrency without expensive equipment and sky-high energy bills.

S

tart earning passive income with our cloud solution – it’s

cheaper and more profitable than mining bitcoins in your garage!

Join us and start earning today!

All questions can be found here. Our manager will answer them within 10 minutes.

cloud mining provider

I every time spent my half an hour to read this web site’s articles daily along with a mug of

coffee.

Hi there! I know this is kinda off topic but I was wondering which blog platform

are you using for this website? I’m getting tired of WordPress because I’ve had issues with hackers and I’m

looking at alternatives for another platform. I would be great if you could point me in the direction of a good

platform.

order deltasone 5mg pills – aprep lson order prednisone without prescription

Wonderful blog! I found it while searching on Yahoo News.

Do you have any suggestions on how to get listed in Yahoo News?

I’ve been trying for a while but I never seem to get there!

Cheers

all the time i used to read smaller articles or reviews which

also clear their motive, and that is also happening with this piece of writing which I

am reading at this place.

You can definitely see your expertise within the article you write.

The world hopes for more passionate writers like you who are not

afraid to mention how they believe. Always follow your

heart.

Hi there, I check your blog regularly. Your writing style is witty, keep doing what you’re doing!

Howdy! I simply would like to offer you a big thumbs up

for the great info you have here on this post.

I will be coming back to your blog for more

soon.

Nice post. I learn something new and challenging

on websites I stumbleupon every day. It will always be helpful to read through articles from

other authors and use a little something from their websites.

Hurrah, that’s what I was looking for, what a stuff!

existing here at this website, thanks admin of this web page.

Feel free to visit my blog post; Kkpoker Rakeback

We are a group of volunteers and opening a new scheme in our

community. Your web site provided us with helpful info to work on.

You have done a formidable task and our whole group might be grateful to you.

Great beat ! I would like to apprentice whilst you amend your website, how can i subscribe for

a blog web site? The account helped me a acceptable deal.

I had been a little bit acquainted of this your broadcast provided

vivid transparent idea

Saved as a favorite, I really like your website!

Have you ever thought about publishing an ebook or guest authoring on other blogs?

I have a blog based upon on the same subjects you discuss and would really like to have you

share some stories/information. I know my readers would value your work.

If you are even remotely interested, feel free to send me an e-mail.

I really like what you guys are usually up too. This kind of clever work and coverage!

Keep up the excellent works guys I’ve incorporated you guys to my personal blogroll.

I think that everything published made a great deal of sense.

But, what about this? what if you wrote a catchier

post title? I am not saying your information is not solid, but suppose

you added a title to possibly grab people’s attention? I mean What Happens If Congress Does Not Raise the Debt Ceiling –

The Truth Central is a little boring. You should glance at Yahoo’s home page and watch how they create post headlines

to grab people to open the links. You might try adding a video or a related

picture or two to get people interested about everything’ve got to say.

Just my opinion, it might bring your posts a little

bit more interesting.

I know this site presents quality based posts and other information, is there any other web page which provides these kinds

of data in quality?

What’s up colleagues, how is all, and what you desire to say on the topic of this piece

of writing, in my view its truly awesome in support of me.

you are in point of fact a excellent webmaster. The web site loading speed is amazing.

It seems that you’re doing any distinctive trick. In addition,

The contents are masterwork. you’ve done a magnificent task in this topic!

Nice weblog right here! Also your site so much up very

fast! What host are you using? Can I am getting your associate hyperlink for your

host? I want my site loaded up as quickly as yours lol

Hello there I am so glad I found your blog, I really found you by error,

while I was looking on Digg for something else, Nonetheless I am here now

and would just like to say thanks for a fantastic post and a all round interesting blog (I also

love the theme/design), I don’t have time to go through it all at the minute but I have book-marked

it and also included your RSS feeds, so when I have time I will be back to read more, Please do keep up

the excellent jo.

sportbets [url=https://sportbets15.ru]https://sportbets15.ru[/url] .

I blog often and I really appreciate your content. The article has

truly peaked my interest. I will book mark your site and keep checking for new information about once

a week. I subscribed to your Feed as well.

It is really a great and helpful piece of info. I’m

glad that you simply shared this helpful information with us.

Please stay us informed like this. Thanks for

sharing.

Hi there i am kavin, its my first occasion to commenting anyplace, when i read

this paragraph i thought i could also make comment due to

this sensible post.

hey there and thank you for your info – I’ve definitely picked up anything new

from right here. I did however expertise some technical points

using this website, as I experienced to reload the website lots

of times previous to I could get it to load properly.

I had been wondering if your web host is OK? Not that

I am complaining, but slow loading instances times

will very frequently affect your placement in google and can damage

your high-quality score if ads and marketing with Adwords.

Well I am adding this RSS to my email and can look out for a

lot more of your respective fascinating content. Ensure that you

update this again soon.

Heya i’m for the first time here. I came across this board and I in finding

It really useful & it helped me out much.

I am hoping to offer something back and aid others such as

you aided me.

My relatives all the time say that I am killing my time here at net, except I know I am getting familiarity everyday

by reading thes good articles or reviews.

Cabihet IQ

15030 N Tatum Blvd #150, Phoenix,

AZ 85032, United Տtates

(480)424-4866

innovation (https://atavi.com/)

I’m not sure exactly why but this web site is loading incredibly slow for me.

Is anyone else having this issue or is it a problem

on my end? I’ll check back later on and see if the problem still exists.

Amazing facts, Many thanks!

For hottest news you have to go to see world-wide-web and on internet I found this web

page as a most excellent web site for most recent updates.

https://paitomacau.top/

It’s actually very complicated in this full of activity life to listen news on Television, thus I only use

internet for that purpose, and take the

most recent news.

WOW just what I was looking for. Came here by searching

for 2wenteez Media

Today, I went to the beach front with my children. I found a sea shell and gave it to

my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She

placed the shell to her ear and screamed.

There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is completely off

topic but I had to tell someone!

I’m really enjoying the design and layout of your website.

It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did

you hire out a designer to create your theme? Outstanding work!

First of all I want to say superb blog! I had a quick question that I’d like to ask if you don’t mind.

I was curious to find out how you center yourself and clear your head prior to writing.

I’ve had trouble clearing my thoughts in getting my ideas out there.

I do take pleasure in writing but it just seems like the first 10 to 15 minutes are usually wasted simply just trying to figure

out how to begin. Any ideas or tips? Many thanks!

Mighty Dog Roofing

13768 Reimer Dr N

Maple Grove, Minnesota 55311, United Ѕtates

(763) 280-5115

hail-proof roof materials – list.ly –

Wow that was unusual. I just wrote an extremely long comment but

after I clicked submit my comment didn’t appear. Grrrr…

well I’m not writing all that over again. Anyways, just wanted to say superb

blog!

With havin so much written content do you ever run into any problems of plagorism or copyright violation? My site has a

lot of exclusive content I’ve either created

myself or outsourced but it seems a lot of it is popping it

up all over the internet without my agreement. Do you know any techniques to help protect against

content from being ripped off? I’d certainly appreciate it.

It’s an remarkable piece of writing in support of all the web

viewers; they will get advantage from it I am sure.

Howdy! I know this is kinda off topic however , I’d figured I’d ask.

Would you be interested in exchanging links or maybe guest authoring

a blog article or vice-versa? My site goes over a lot of the same topics as yours and I think we could greatly benefit from

each other. If you might be interested feel free

to send me an email. I look forward to hearing from you!

Great blog by the way!

I could not resist commenting. Very well written!

If some one needs expert view about blogging and site-building after that i propose

him/her to visit this webpage, Keep up the nice job.

This design is incredible! You obviously know how

to keep a reader amused. Between your wit and your videos, I was almost

moved to start my own blog (well, almost…HaHa!) Excellent

job. I really loved what you had to say, and more than that, how you presented

it. Too cool!

I am truly glad to read this weblog posts which contains lots of

useful data, thanks for providing these kinds of data.

I get pleasure from, result in I found exactly what I was looking for.

You have ended my four day long hunt! God Bless you man. Have a

nice day. Bye

Cabinet IQ

15030 N Tatum Blvdd #150, Phoenix,

AZ 85032, United Տtates

(480) 424-4866

Interiorexperts

Howdy! This blog post couldn’t be written much better!

Looking through this post reminds me of my previous roommate!

He constantly kept preaching about this. I’ll send this article

to him. Pretty sure he’ll have a very good read.

Thank you for sharing!

You really make it seem so easy with your presentation but I find

this topic to be really something which I think I would never understand.

It seems too complicated and extremely broad for me.

I am looking forward for your next post, I will try to

get the hang of it!

Soho303 – KI BAK LAHH

SITUS SLOT GACOR MUDAH WIN !

Your style is very unique in comparison to other people I have read stuff from. I appreciate you for posting when you’ve got the opportunity, Guess I will just bookmark this site.

I had no idea posture and upper body tension could affect bladder control—this program really connects the dots in a way most

fitness routines don’t!”

I must thank you for the efforts you’ve put in penning this blog.

I really hope to check out the same high-grade content by you in the future as

well. In truth, your creative writing abilities has motivated me to get my own website

now 😉

Magnificent goods from you, man. I have take into account your stuff previous to and you’re just too magnificent.

I actually like what you’ve got here, really like what you are saying and the way in which you say it.

You are making it enjoyable and you continue to care for to keep it sensible.

I can’t wait to read far more from you. This is

actually a terrific web site.

If you are going for best contents like myself, simply pay a quick visit this site

all the time because it presents feature contents, thanks

Nice blog here! Also your website rather a lot

up fast! What web host are you using? Can I am getting your associate hyperlink for your host?

I desire my site loaded up as fast as yours lol

Tһіs blog is a timely contribution t᧐ modern lending.

Consіdering the boom іn digital risk management, banks neеd smart tools

ⅼike loan decisioning software tо ensure accuracy.

Innovations suсh as loan origination automation prove

tһe impactt of automated loan systems. І

trᥙly admire уoսr mention ⲟf Digital Transformation tools.

Ꮮooking forward to more contеnt like thіs veгу useful ffor

finabcial professionals.

Ηere іs mʏ web page: Credit risk management software for banks

Definitely believe that which you said. Your favourite reason seemed to be at the web the easiest thing to bear in mind of. I say to you, I certainly get annoyed even as other people consider worries that they just don’t understand about. You managed to hit the nail upon the top as neatly as outlined out the entire thing without having side effect , folks can take a signal. Will likely be again to get more. Thanks

Thanks for the helpful post! I recently used installturbotax.com

to download and install TurboTax, and the process was super smooth.

Just entered my license code, followed the steps, and was ready to file in no time.

Definitely a convenient way to get started with your taxes

without any hassle. Great tool for anyone looking to file quickly

and accurately!

I like reading through an article that can make people think.

Also, many thanks for permitting me to comment!

always i used to read smaller articles that as well clear their

motive, and that is also happening with this article which I am reading here.

At this time it sounds like BlogEngine is the best blogging platform available right now.

(from what I’ve read) Is that what you are

using on your blog?

sportbets [url=www.sportbets14.ru]www.sportbets14.ru[/url] .

Hello would you mind letting me know which web host you’re using?

I’ve loaded your blog in 3 different browsers and I must say this blog loads a lot faster then most.

Can you suggest a good web hosting provider at a reasonable price?

Thank you, I appreciate it!

Very nice post. I just stumbled upon your blog and wished to mention that I’ve truly loved surfing around your blog posts.

In any case I will be subscribing on your rss feed and I am hoping you write once more very soon!

большие высокие горшки для цветов [url=https://kashpo-napolnoe-spb.ru/]https://kashpo-napolnoe-spb.ru/[/url] .

Thanks , I’ve just been looking for information approximately this topic for ages and yours is the

best I’ve came upon so far. However, what

in regards to the conclusion? Are you certain about the source?

I do not even know how I ended up here, but I thought this post

was great. I don’t know who you are but definitely you are going to a famous blogger

if you aren’t already 😉 Cheers!

Hmm it looks like your site ate my first comment (it was extremely long) so I guess I’ll

just sum it up what I submitted and say, I’m thoroughly

enjoying your blog. I too am an aspiring blog blogger but I’m still new to the whole

thing. Do you have any helpful hints for rookie blog writers?

I’d genuinely appreciate it.

id=”firstHeading” class=”firstHeading mw-first-heading”>Search results

Help

English

Tools

Tools

move to sidebar hide

Actions

General

You actually explained this terrifically. https://slot-betflik.bet

Thank you for every other wonderful article. Where else may just anyone get that kind of

information in such an ideal approach of writing?

I have a presentation next week, and I’m on the look for such information.

Hello friends, its enormous paragraph about tutoringand completely

explained, keep it up all the time.

You mentioned it exceptionally well.

Link Slot Kaptenasia

If you want to get much from this paragraph then you have

to apply such methods to your won blog.

Hey excellent blog! Does running a blog such as this take a

massive amount work? I’ve no understanding of computer programming but I had been hoping to

start my own blog soon. Anyways, if you have any suggestions or techniques for new blog owners please share.

I understand this is off subject however I simply had to ask.

Thank you!

When someone writes an piece of writing he/she maintains the image of a user in his/her mind that how a user can know

it. So that’s why this article is amazing. Thanks!

Thanks for another informative web site. The place else may just I get

that kind of info written in such an ideal method?

I’ve a challenge that I am simply now operating on, and I’ve

been at the look out for such information.

Thanks for the marvelous posting! I quite enjoyed reading it, you can be a great author.I will ensure that I bookmark your blog and will often come back from now on. I want to

encourage you continue your great job, have a nice afternoon!

Hi, I think your site might be having browser compatibility issues.

When I look at your website in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping.

I just wanted to give you a quick heads up!

Other then that, amazing blog!

Saved as a favorite, I really like your blog!

My web-site … zorroescu01

Hey! This is kind of off topic but I need some guidance from

an established blog. Is it tough to set up your own blog?

I’m not very techincal but I can figure things out pretty

quick. I’m thinking about creating my own but I’m not sure where to begin. Do you have any tips or

suggestions? Appreciate it

Good replies in return of this difficulty with firm

arguments and explaining everything about that.

Hi, just wanted to say, I loved this article. It was helpful.

Keep on posting!

If you are going for most excellent contents like myself, simply visit this site everyday because it gives quality

contents, thanks

I do consider all the ideas you’ve presented on your post.

They are really convincing and can definitely work. Nonetheless, the posts are very quick for beginners.

Could you please extend them a little from subsequent time?

Thanks for the post.

Link Slot Kaptenasia

цветочные горшки большие напольные пластиковые купить [url=https://kashpo-napolnoe-spb.ru/]цветочные горшки большие напольные пластиковые купить[/url] .

Mitolyn reviews consumer reports show positive

feedback from users praising its effectiveness in boosting energy and supporting vitality.

Trusted evaluations confirm Mitolyn as a reliable supplement for enhancing

overall wellness.

Great article.

Hi Dear, are you genuinely visiting this web site daily, if so afterward you will

definitely get fastidious experience.

70918248

References:

best steroid pill; https://newsstroy.kharkiv.ua/novosti-biatlona-2.html,

Hi, yeah this article is really nice and I have learned

lot of things from it regarding blogging. thanks.

It’s haгd to come Ƅy knowledgeabloe people Massage in Karachi thіѕ pɑrticular subject, Ьut you sound

ljke yoᥙ knoᴡ what yoս’гe talking about! Thanks

This was super informative! I’ve been feeling low on energy lately and looking for something

more natural to help. Red Boost sounds promising, especially

with the focus on circulation and vitality. Appreciate the honest breakdown!

шторы на окна купить [url=http://rulonnye-shtory-s-elektroprivodom15.ru]шторы на окна купить[/url] .

Heya i’m for the primary time here. I found this board

and I find It truly useful & it helped me out a lot.

I am hoping to provide one thing back and help

others such as you aided me.

I am truly delighted to read this web site posts which carries plenty of helpful facts, thanks for providing these information.

рулонные шторы купить в москве [url=http://elektricheskie-rulonnye-shtory99.ru]рулонные шторы купить в москве[/url] .

Hello, I want to subscribe for this blog

to take most up-to-date updates, thus where can i do it please help out.

I have been surfing online more than 4 hours today, yet I never found any interesting

article like yours. It is pretty worth enough for me.

In my opinion, if all site owners and bloggers made good content as

you did, the web will be much more useful than ever before.

игры с бесконечными деньгами — это интересный способ изменить игровой опыт. Особенно если вы пользуетесь устройствами на платформе Android, модификации открывают перед вами широкие горизонты. Я нравится использовать игры с обходом системы защиты, чтобы развиваться быстрее.

Модификации игр дают невероятную свободу выбора, что взаимодействие с игрой гораздо интереснее. Играя с плагинами, я могу добавить дополнительные функции, что добавляет виртуальные путешествия и делает игру более захватывающей.

Это действительно захватывающе, как такие изменения могут улучшить игровой процесс, а при этом с максимальной безопасностью использовать такие взломанные версии можно без особых рисков, если быть внимательным и следить за обновлениями. Это делает каждый игровой процесс более насыщенным, а возможности практически выше всяких похвал.

Рекомендую попробовать такие игры с модами для Android — это может переведет ваш опыт на новый уровень

взломанные игры для слабых телефонов — это интересный способ расширить функциональность игры. Особенно если вы играете на мобильном устройстве с Android, модификации открывают перед вами новые возможности. Я нравится использовать игры с обходом системы защиты, чтобы удобнее проходить игру.

Модификации игр дают невероятную персонализированный подход, что погружение в игру гораздо захватывающее. Играя с твиками, я могу персонализировать свой опыт, что добавляет приключенческий процесс и делает игру более захватывающей.

Это действительно удивительно, как такие модификации могут улучшить взаимодействие с игрой, а при этом не нарушая использовать такие игры с изменениями можно без особых неприятных последствий, если быть внимательным и следить за обновлениями. Это делает каждый игровой процесс персонализированным, а возможности практически широкие.

Рекомендую попробовать такие модифицированные версии для Android — это может придаст новый смысл

70918248

References:

craig davidson steroids, https://mealpe.app/mealpe-bulk-meal-solution-india-corporate-enterprise/,