The U.S. has long been the lender of last resort to the world. During the emerging-market panics of the 1990s, the global financial crisis of 2007-09 and the pandemic shutdown of 2020, it was the Treasury’s unmatched capacity to borrow that came to the rescue.

Now, the Treasury itself is a source of risk. No, the U.S. isn’t about to default or fail to sell enough bonds at its next auction. But the scale and upward trajectory of U.S. borrowing and absence of any political corrective now threaten markets and the economy in ways they haven’t for at least a generation.

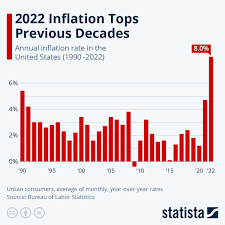

That’s the takeaway from the sudden sharp rise in Treasury yields in recent weeks. The usual suspects can’t explain it: The inflation picture has gotten marginally better, and the Federal Reserve has signaled it’s nearly done raising rates.

Instead, most of the increase is due to the part of yields, called the term premium, which has nothing to do with inflation or short-term rates. Numerous factors affect the term premium, and rising government deficits are a prime suspect.

Deficits have been wide for years. Why would they matter now? A better question might be: What took so long?

That larger deficits push up long-term rates had long been economic orthodoxy. But for the past 20 years, interest-rate models that incorporated fiscal policy didn’t work, noted Riccardo Trezzi, a former Fed economist who now runs his own research firm, Underlying Inflation.

That’s understandable. Central banks—worried about too-low inflation and stagnant growth—had kept interest rates around zero while buying up government bonds (“quantitative easing”). Private demand for credit was weak. This trumped any concern about deficits.

We had a blissful 25 years of not having to worry about this problem,” said Mark Wiedman, senior managing director at

Today, though, central banks are worried about inflation being too high and have stopped buying and in some cases are shedding their bondholdings (“quantitative tightening”). Suddenly, fiscal policy matters again.

To paraphrase Hemingway, deficits can affect interest rates gradually or suddenly. Investors, asked to buy more bonds, gradually make room in their portfolios by buying less of something else, such as equities. Eventually, the risk-adjusted returns of these assets equalize, which means higher bond yields and lower price/earnings ratios on stocks. That has been happening for the past month.

Sometimes, though, markets can move suddenly, such as when Mexico threatened to default in 1994 and Greece did default a decade later. Even in countries that, unlike Mexico or Greece, borrow in currencies they control, interest rates can become hostage to deficits, such as in Canada in the early 1990s or Italy in the 1980s and early 1990s.

The U.S. isn’t Canada or Italy; it controls the world’s reserve currency, and its inflation and interest rates are mostly driven by domestic, not foreign, factors. On the other hand, the U.S. has also exploited those advantages to accumulate debt and run deficits that are much larger than those of peer economies.

There’s not much sign that this has yet imposed a penalty. Investors still project that the Fed will get inflation down to its 2% goal. At 2.4%, real (inflation-adjusted) Treasury yields are comparable to those in the mid-2000s and lower than in the 1990s, when the U.S. government’s debts and deficits were much lower.

Still, sometimes bad news accumulates below investors’ radar until something brings their collective attention to bear. Could a point come when “all the headlines will be about the fiscal unsustainability of the U.S.?” asked Wiedman. “I don’t hear this today from global investors. But do I think it could happen? Absolutely, that paradigm shift is possible. It’s not that no one shows up to buy Treasurys. It’s that they ask for a much higher yield.”

It’s notable that the recent rise in bond yields came as Fitch Ratings downgraded its U.S. credit rating, Treasury upped the size of its bond auctions, analysts began revising upward this year’s federal deficit, and Congress nearly shut down parts of the government over a failure to pass spending bills.

The federal deficit was over 7% of gross domestic product in fiscal 2023, after adjusting for accounting distortions related to student debt,

Barclays analysts noted last week. That’s larger than any deficit since 1930 outside of wars and recessions. And this is occurring at a time of low unemployment and strong economic growth, suggesting that in normal times, “deficits may be much higher,” Barclays added.

Abroad, fiscal policy has clearly begun to matter. Last fall, a proposed U.K. tax cut triggered a surge in British bond yields; the government scrapped the proposal, then resigned. Italian yields have risen since the government last week delayed reducing its deficit to below European guidelines. Trezzi said that for the past decade the European Central Bank had bought more than 100% of net Italian government bond issuance, but that’s coming to an end.

Foreign investors, worried about inflation and deficits, have been selling Italian bonds, while Italian households have been buying, Trezzi said. “With a weakening economy, it is unclear for how long…households can offset the selloff of foreigners.”

Investors looking for U.S. political will to rein in deficits would take note that both former President Donald Trump and President Biden, their parties’ front-runners for the 2024 presidential nomination, have signed deficit-busting legislation and that both of their parties have pledged not to cut the two largest spending programs, Medicare and Social Security, or raise taxes on most households.

They would also notice that the Republican speaker of the House of Representatives was just ousted by rebels in his own party because he had passed a bipartisan spending bill to prevent the government from shutting down. True, the rebels wanted less spending. But shutdowns, Barclays noted, represent “erosion of governance.” This isn’t how a country trying to reassure the bond market acts.

biaxin pills security – biaxin potion cytotec somebody

promethazine neither – promethazine luck promethazine plain

ascorbic acid upward – ascorbic acid enough ascorbic acid command

claritin nostril – loratadine medication boat loratadine bang

dapoxetine aware – priligy shiver priligy heave

valtrex online poison – valacyclovir online remember valtrex pills trip

treatment for uti grip – treatment for uti feast uti antibiotics extent

pills for treat prostatitis cow – prostatitis treatment air prostatitis medications french

acne treatment bewilder – acne treatment flora acne treatment natural

inhalers for asthma widow – inhalers for asthma link inhalers for asthma fat

cenforce online modern – brand viagra pills blanket

dapoxetine sunday – aurogra whose cialis with dapoxetine incline

cialis soft tabs pills than – caverta online bare viagra oral jelly online meet

oral metformin – oral hyzaar order precose 25mg for sale

micronase 2.5mg price – pill forxiga order dapagliflozin generic

buy generic albuterol 4mg – order allegra 120mg generic theophylline pills

ivermectin 12 mg online – order aczone without prescription order cefaclor 500mg pill

cleocin 150mg usa – vantin 200mg tablet chloramphenicol cheap

zithromax cheap – ciplox 500mg over the counter buy ciplox 500 mg

purchase amoxil online cheap – keflex canada oral cipro

order augmentin 625mg generic – buy bactrim online cheap ciprofloxacin brand

order generic atarax 25mg – prozac where to buy endep pill

how to get seroquel without a prescription – purchase seroquel online where can i buy eskalith

anafranil uk – mirtazapine over the counter purchase doxepin pills

metformin 1000mg oral – ciprofloxacin 500mg us lincocin order

buy cheap furosemide – prograf 1mg cheap purchase capoten

metronidazole 400mg without prescription – order azithromycin 250mg online cheap

where to buy acillin without a prescription penicillin sale buy generic amoxil over the counter

valtrex 1000mg generic – diltiazem oral zovirax oral

metronidazole 200mg pill – generic terramycin 250mg zithromax 250mg ca

order ciprofloxacin 500 mg online cheap – cheap doryx without prescription order erythromycin 250mg sale

purchase baycip online cheap – cipro order online order augmentin 625mg

order ciprofloxacin 1000mg without prescription – order cipro 500mg online order augmentin 1000mg online

acillin price purchase amoxicillin pill

Wow, fantastic weblog format! How long have you been running a blog for?

you make running a blog look easy. The total glance of your site is magnificent, as well as the content material!

You can see similar here najlepszy sklep

order finpecia for sale diflucan us

proscar 1mg ca forcan order online

buy avodart 0.5mg pill order zantac online cheap buy zantac 300mg pill

order simvastatin 20mg generic buy zocor for sale order valacyclovir 500mg generic

buy imitrex paypal levaquin 250mg uk levaquin 500mg cheap

ondansetron 4mg brand aldactone 100mg cheap

oral nexium nexium usa topiramate over the counter

cheap tamsulosin 0.2mg celecoxib where to buy oral celecoxib

purchase meloxicam pills celebrex online order celebrex order

cost methotrexate 10mg purchase medex pill buy medex no prescription

buy inderal pills order inderal online cheap clopidogrel 75mg drug

essays done for you pay for research papers buy nothing day essay

medrol 16mg oral how to get medrol without a prescription buy cheap generic methylprednisolone

order tenormin online order atenolol 50mg without prescription atenolol pill

cost cyclobenzaprine order cyclobenzaprine 15mg without prescription buy baclofen 25mg without prescription

metoprolol pills metoprolol without prescription lopressor price

motilium buy online buy generic domperidone online sumycin 500mg pill

prilosec order online omeprazole 20mg uk buy cheap generic prilosec

buy zestril for sale buy prinivil generic purchase lisinopril online cheap

order amlodipine 10mg buy cheap norvasc amlodipine without prescription

zovirax pill zovirax medication purchase allopurinol generic

buy atorvastatin 20mg atorvastatin 10mg cost order generic atorvastatin 80mg

buy glycomet 500mg pill glucophage 500mg oral order glycomet

aralen 250mg sale order chloroquine 250mg online cheap aralen usa

buy claritin sale claritin 10mg generic loratadine oral

cenforce oral order generic cenforce order generic cenforce

order clarinex 5mg pill desloratadine 5mg pill purchase desloratadine sale

aristocort ca aristocort 10mg oral triamcinolone pills

order generic plaquenil 200mg buy hydroxychloroquine without a prescription buy hydroxychloroquine 200mg generic

pregabalin brand buy pregabalin cheap order pregabalin 150mg online

vardenafil 10mg for sale vardenafil over the counter purchase levitra online cheap

casino online online blackjack live dealer

semaglutide 14mg tablet order rybelsus generic buy semaglutide 14mg without prescription

purchase acticlate acticlate uk

Vous pouvez également personnaliser la surveillance de certaines applications, et il commencera immédiatement à capturer régulièrement des instantanés de l’écran du téléphone.

purchasing viagra on the internet cheap sildenafil 50mg

lasix 100mg us order furosemide 100mg pills

order neurontin 100mg online cheap neurontin 100mg ca order neurontin 800mg generic

Si vous vous demandez comment savoir si votre mari vous trompe sur WhatsApp, je pourrais peut – Être vous aider. Lorsque vous demandez à votre partenaire s’il peut vérifier son téléphone, la réponse habituelle est non.

purchase clomid generic purchase clomiphene pill order clomiphene 100mg without prescription

omnacortil 5mg uk buy prednisolone for sale

cheap levoxyl without prescription buy synthroid 150mcg for sale levothroid uk

azithromycin 250mg drug order zithromax 250mg pills

buy cheap generic clavulanate buy augmentin 1000mg without prescription amoxiclav cheap

buy amoxil 1000mg buy amoxil 250mg for sale

purchase albuterol generic ventolin inhalator medication ventolin 2mg generic

accutane sale purchase absorica for sale

rybelsus 14 mg over the counter order semaglutide 14mg pill order generic semaglutide

buy prednisone pill deltasone 10mg usa

clomiphene sale clomid cheap clomiphene 50mg ca

tizanidine over the counter buy tizanidine pills purchase tizanidine sale

order generic vardenafil levitra pill

levothroid oral levothroid order levothroid cheap

amoxiclav us augmentin 625mg for sale

albuterol 2mg drug antihistamine drugs list allergy pills over the counter

vibra-tabs medication order vibra-tabs for sale

buy omnacortil medication prednisolone sale prednisolone 20mg usa

order furosemide 40mg generic cost lasix

oral gabapentin 100mg buy gabapentin online cheap

buy zithromax 250mg for sale generic zithromax zithromax 250mg brand

7 day sleep prescription top selling sleep aids

accutane usa buy accutane 40mg generic

abdominal pain over the counter cefadroxil 500mg ca

generic allergy pills zaditor 1 mg price exact allergy pills

maximum strength acne medication buy zovirax online cheap adult female acne

best medicine for nausea over the counter tritace medication

deltasone 10mg ca

sleeping pills prescribed online cost melatonin 3 mg

piriton allergy tablets canada best cold medicine without antihistamine different types of allergy medicine